University Newsletter — News from Old Main

-

Spring 2024 Commencement - Faculty Participation

READ MORE

Any faculty members wishing to participate in the Spring 2024 Commencement ceremonies should fill out the form below. This will help us prepare for seating arrangements and allow for reserved parking.

Commencement is Saturday, May 4 - Groniger Arena

- 10 a.m. – Undergraduate Degrees in the College of Education & College of Liberal Arts and Sciences

- 1:30 p.m. – All Graduate Degrees

- 5 p.m. - Undergraduate Degrees in Lumpkin College of Business and Technology & College of Health and Human Services

Permalink

Anyone needing to order commencement regalia, please do so at https://colleges.herffjones.com/college/_eiufaculty/.

For any additional questions, please contact Koty Gough at dlgough2@eiu.edu. -

J-LOT & Stadium Parking Lots to Close for Special Olympics April 25 & 26

READ MORE

TEMPORARY LOT CLOSURE NOTICE: In light of the Special Olympics Illinois - Spring Games 2024 taking place at the Stadium on April 26, both the Stadium and J-Lots will be closed starting from 8 p.m. on Thursday, April 25. These closures will be in effect until the conclusion of the event on Friday night. Please make use of alternative parking lots assigned to your permit. We appreciate your cooperation and understanding during this temporary inconvenience. Thank you for your support during this temporary inconvenience

Permalink -

DWF Collaborative Redesign Initiative Grantees

READ MORE

Congratulations to the eight departments who are the recipients of the DWF Collaborative Redesign Initiative Grants!

BIO 1001G

- Dr. Thomas Canam, Chair

- Dr. Eden Effert-Fanta, Redesign Lead

CHM 1310G

- Dr. Edward Treadwell, Chair

- Dr. Tiffany Pellizzeri, Redesign Lead

CMN 1310G

- Dr. Matt Gill, Chair

- Dr. Nora Heist, Redesign Lead

ENG 1001G

- Dr. Angela Vietto, Chair

- Dr. Timothy Taylor, Redesign Lead

HSL 1800

- Dr. Jill Bowers, Chair

- Dr. Christopher Maniotes, Redesign Lead

MAT 1160G

- Dr. Marshall Lassak/Dr. Andrew Mertz, Chair

- Dr. Amanda Welch, Redesign Lead

MUS 2555G

- Dr. Shellie Gregorich, Chair

- Dr. Magie Beck, Redesign Lead

PUBH 2200G

- Dr. Julie Dietz, Chair

- Dr. Aimee Janssen-Robinson and Ms. Emma Noble, Redesign Leads

The DWF Collaborative Redesign Initiative is a strategic effort aligned with Activity 1.22 of Plan 2028, which aims to improve retention and graduation rates for all EIU learners. These grantees will receive $5,000 in collaborative redesign grants to support efforts during Summer 2024, a total of 0.25 CUs for a faculty redesign leader or leaders, and direct consultation and support from the FDIC.This initiative is innovative and novel both through its collaborative design and strategic planning. A full evaluation of the initiative is also underway as we launch the initiative on April 15, 2024. For more information, please visit: https://www.eiu.edu/fdic/dwfredesign.php.

Permalink -

Herb Breidenbach Obituary

READ MORE

-

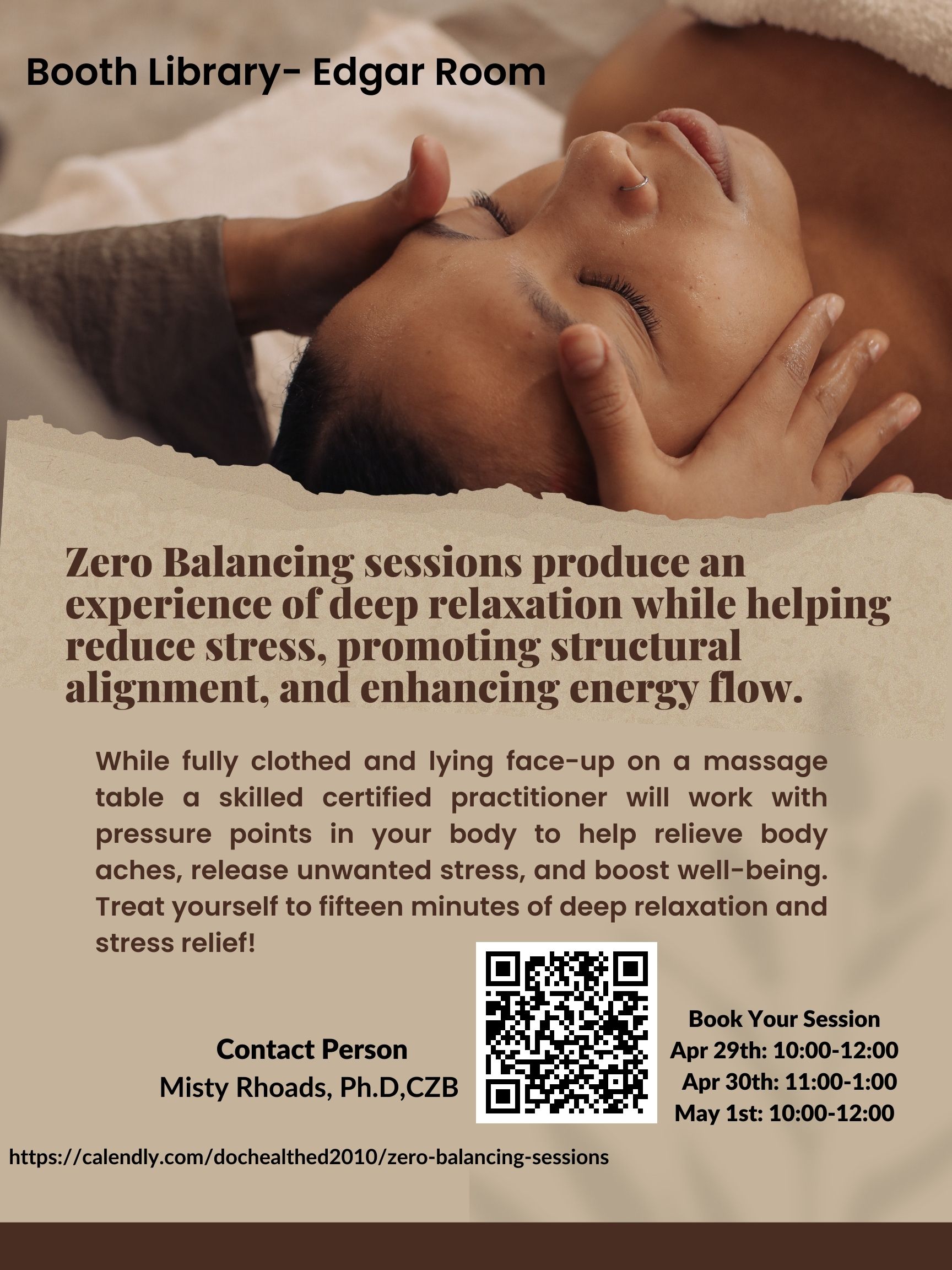

Zero Balancing Sessions at Booth Library in Late April, Early May

READ MORE

As a part of Booth Library Finals Week Activities- Zero Balancing sessions will again be offered by EIU’s Dr. Misty Rhoads in the library’s Edgar Room. During the sessions, participants will remain fully clothed and lay face up on a massage table while Rhoads works with pressure points in the body to help relieve body aches, release stress and boost well-being. Appointments are requested for these 15-minute free sessions. Visit https://calendly.com/dochealthed2010/zero-balancing-sessions?month=2024-04 to reserve a spot! Sessions are offered from

April 29: 10am-12pm

April 30:11am-1pm

May 1: 10am-12pm

Permalink -

Therapy Dogs at Booth April 29, 30

READ MORE

As part of Booth Library Finals Week Activities- On April 29 & 30, members of All Things Pawsitive will bring certified therapy dogs to the library's south entrance from 2 to 4 p.m. Don't miss this chance to destress with some furry friends!

Permalink

-

Snack Break at Booth Library During Finals Week

READ MORE

As part of Booth Library Finals Week Activities- stop by Booth from 4pm-6pm for FREE snack on Booth Bridge (main floor)! Be sure to check out the rest of finals week activities at Booth Library!

Permalink

-

Staff Senate Election Results

READ MORE

Congratulations to the following individuals who have been elected to Staff Senate, with terms beginning July 1, 2024:

- Jordan Jenkins - AFSCME 981

- Amy Morris - Non-Negotiated Civil Service

- Tony Craven - Non-Negotiated Trades

~Staff Senate Election Committee

Permalink -

Heumann, Murray to see book published in Fall 2024

READ MORE

Joseph Heumann (Emeritus Professor School of Communication-Journalism) and Robin L Murray (Emeritus Professor Dept of English) have been informed that their book length manuscript, Eco Teen Films, has been accepted for publication by Routledge Press (New York, London) and will appear in print in the Fall of 2024.

Permalink -

Dean of Students On-Campus Interviews

READ MORE

Open sessions for the position of Dean of Students are being held on Friday, April 12.

- Student Session (lunch provided): 12-12:50 p.m., Casey Room, MLK Jr. University Union

- Faculty/Staff Session: 1-1:50 p.m., Casey Room, MLK Jr. University Union

Additional candidate sessions will be announced soon. Visit eiu.edu/search_dos for updates.

Permalink -

WEIU TV Now Streaming Live on YouTube TV

READ MORE

WEIU is now streaming live on YouTube TV. YouTube TV provides viewers another way to enjoy the WEIU and PBS content they love.

With WEIU's dedicated live YouTube TV channel, viewers can find episodes from WEIU original series such as "Being Well," "City Spotlight", "Take A Hike", "Issues & Attitudes", and "The Paw Report," along with PBS favorites including "American Masters," "Antiques Roadshow," "Finding Your Roots," "American Experience," "Austin City Limits", "This Old House" and more.

Viewers can also find a live channel for PBS KIDS that features favorite series such as "Daniel Tiger's Neighborhood," "Molly of Denali," "Odd Squad," "Pinkalicious and Peterrific," Wild Kratts" and "Sesame Street."

In addition to WEIU and PBS programming, YouTube TV also offers cable-free live TV to YouTube subscribers with more than 70 major broadcast and cable networks, including ABC, CBS, FOX and NBC plus cable networks like TNT, TBS, CNN, ESPN, AMC and FX. YouTube TV features a cloud-based DVR without storage space limits, six accounts per household, and streaming on your phone, tablet, computer and TV.

To access the full line-up available on WEIU, you can visit the YouTube TV live guide online or the WEIU schedule on our website www.weiu.net.

In addition to YouTube TV, WEIU content is also available on PBS.org as well as the PBS App available on iOS, Android, Roku, Apple TV, Amazon Fire TV, Chromecast and Samsung smart TVs. WEIU members are also able to view an extended library of quality public television programming through PBS Passport, an added member benefit.

Permalink -

Sexual Assault Awareness Month in April

READ MORE

This April marks the 23rd anniversary for Sexual Assault awareness month. Everyone is affected by sexual violence. Join the Interpersonal Violence Awareness Team this month as we partner with Prevail, the HERC, Housing, Counseling Clinic, and many others across campus to increase awareness through programs and outreach events.

Join us April 2nd and wear Teal, the color of sexual violence prevention, to take action and start off the month. On April 10th, Prevail and the Counseling Clinic will be holding a Candlelight Vigil for survivors at the Mellin Steps. Wear jeans with purpose on April 24th, Denim Day, to support survivors.

Follow the Interpersonal Violence Awareness Team on Instagram to stay updated with events, programs, and other awareness efforts : https://www.instagram.com/eiu_ivat/

For more information on Sexual Assault Awareness month, visit https://www.nsvrc.org/saam or on Denim Day at https://www.peaceoverviolence.org/denim-day

Permalink

-

EIU EMPLOYEE 2024 SUMMER HOURS

READ MORE

As outlined in IGP 19, employees, whose work assignments allow, to compress their normal five-day workweek into a 4.5-day workweek. Please be sure to turn off computers, lights, and personal air conditioning units if you have them to help improve our energy efficiency.

Campus-wide summer office hours will be in effect from Monday, May 6, through Friday, August 9. This year, flex schedules will be honored during the holiday weeks as well. Please ensure the work week consists of at least 37.5 hours of work hours, vacation and/or sick leave. Supervisors are responsible for accurate recording of time.

When summer office hours are in effect, all offices must be open Monday through Thursday between 8 a.m. to noon and 1 to 4:30 p.m. and on Friday from 8 a.m. until noon.

Due to ongoing operational needs, offices including, but not limited to, University Police, Booth Library, and the Renewable Energy Center, will keep regular business hours and remain open on Friday afternoons.

Holidays will be observed on Monday, May 27 for Memorial Day, Wednesday, June 19 for Juneteenth, and Thursday, July 4 for Independence Day.

Classes scheduled to meet on Friday afternoons will be relocated to buildings where the air conditioning will remain on.

Employees are to work with supervisors to ensure that a 37.5-hour workweek is accomplished. Each office is to change voice mail, signage, and other public communication to reflect its summer hours. Regular business hours will resume on Monday, Aug. 12.

If you need to complete your flex schedule, please visit webappsprod.eiu.edu/flexschedules/login. This link allows employees to complete a request, obtain supervisor's approval, and submit documents and requests to Benefits for final approval.

Questions may be directed to Human Resources at benefits@eiu.edu or by calling 217-581-5825.Thank You!

Human Resources

Permalink -

PART-TIME STUDENT INSURANCE FOR PART-TIME, ONLINE AND OFF CAMPUS STUDENTS

READ MORE

Student Insurance is available for the Summer 2024 term. The coverage effective dates are 5/13/2024-8/11/2024. The cost for the coverage is $87.45.

Students who are insured in Spring 2024, who desire Summer coverage and will not be enrolled in the Summer Term, may obtain coverage by submitting the Summer 2024 Enrollment Form available in their PAWS account, under the MyHealth tab prior to 5/12/24.

Students who enroll for 5 or more hours for the Summer Term may obtain coverage by submitting the Summer 2024 Enrollment Form available in their PAWS account, under the MyHealth tab prior to 5/21/24. Coverage is effective upon receipt of the enrollment form.

Student Insurance provides the student worldwide protection 24 hours a day. The Plan has a $100 deductible per diagnosis and pays up to 70% of eligible expenses for physician and hospital expenses, lab and x-ray, surgery, ambulance transport, physical therapy, maternity expenses, mental health and substance abuse issues. The Student Insurance Plan also reduces copays for prescription medications at the Health Services on campus.

Unlike an HMO or PPO, the Plan does not have a network, giving students a choice in their care and provides coverage for treatment the student receives while they are at home, at school, and wherever they may travel.

Student Insurance is an economical way to reduce or eliminate out-of-pocket expenses when family health plans do not cover 100% of medical costs because of deductibles, co-payment amounts, limitations on specific benefits, and out-of-network penalties. The Student Insurance Plan complements the family health plan. Most students find it beneficial to carry both, particularly if the family plan has a deductible and/or coinsurance.

You can find more information about the Plan at www.eiu.edu/studentinsurance or by contacting our office at 217-581-5290. There are 2 short videos on the website that do a nice job of explaining all about the Plan.

Permalink -

STUDENT INSURANCE WAIVERS AVAILABLE

READ MORE

Student Insurance provides the student worldwide protection, 24 hours a day. The Plan has a $100 deductible per diagnosis and pays up to 70% of eligible expenses for physician and hospital expenses, lab and x-ray, surgery, ambulance transport, physical therapy, maternity expenses, mental health and substance abuse issues. The Student Insurance plan also covers prescriptions at the Health Services on campus.

Unlike an HMO or PPO, the Plan does not have a network, giving students a choice in their care and provides coverage for treatment the student receives while they are at home, at school, and wherever they may travel. When you have other insurance, the Plan coordinates with the primary carrier. Student Insurance is an economical way to reduce or eliminate out-of-pocket expenses when family health plans do not cover 100% of medical costs because of deductibles, co-payment amounts, limitations on specific benefits, and out-of-network penalties. The Student Insurance Plan complements the family health plan. Most students find it beneficial to carry both, particularly if the family plan has a deductible and/or coinsurance.

You can find more information about the Plan at www.eiu.edu/studentinsurance or by contacting our office at 217-581-5290. There are 2 short videos on the website that do a nice job of explaining all about the Plan.

The Summer 2024 Student Insurance fee will be automatically assessed to students enrolled in an on-campus program taking 9 or more hours; graduate assistants under contract to the University; and international students enrolled in an on-campus program taking 3 or more hours.

Students wishing to waive the Student Insurance Plan must complete the Waiver Form available in their PAWS account, under the MyHealth tab. The deadline to waive coverage for the Summer 2024 semester is May 21, 2024.

Permalink -

FDIC is seeking an Instructional Support and Training Specialist for CLAS

READ MORE Eastern Illinois University’s Faculty Development and Innovation Center is seeking qualified applicants for the position of Program Coordinator – Instructional Support and Training Specialist. This position will be part of the FDIC team and provide faculty training and support with instructional technologies for face-to-face, hybrid, and online courses with a focus on the College of Liberal Arts and Sciences, though may also serve other colleges as needed.

Eastern Illinois University’s Faculty Development and Innovation Center is seeking qualified applicants for the position of Program Coordinator – Instructional Support and Training Specialist. This position will be part of the FDIC team and provide faculty training and support with instructional technologies for face-to-face, hybrid, and online courses with a focus on the College of Liberal Arts and Sciences, though may also serve other colleges as needed.Duties will include:

- Train and assist faculty in incorporating a wide range of teaching technologies into face-to-face, hybrid, and online classes.

- Serve as a subject matter expert in academic technologies to assist faculty in incorporating the right technology to support their courses.

- Provide faculty with one-on-one and group instructional technology training for D2L Brightspace, Microsoft Teams, Adobe Creative Suite, Office 365, Zoom, Turnitin, Respondus, Kaltura, and other systems utilized by EIU.

- Train and assist faculty on technology use in face-to-face, hybrid, and online environments.

- Develop written and video training materials for EIU specific technologies.

- Advise the Director of the Faculty Development and Innovation Center on instructional technology needs and new and emerging technologies.

- Collaborate with the Center for Student Innovation (CSI) on instructional technology initiatives.

Required Qualifications:

- Master’s degree in Educational Technology, Training and Development, Digital Media Technology, Organizational Development, or a closely related field.

- One year of experience that includes both of the following:

- Experience with a learning management system

- Experience teaching and or training

(A Bachelor’s degree in an area consistent with the duties of the position plus three years of the above experience may be considered.)

The Civil Service Examination for this classification is a credentials assessment. No participation other than submission of applicant materials is required from qualified applicants. Upon successful selection of a candidate, all scores will be voided from this Program Coordinator – Training and Development Specialist register.

To apply, please submit application, resume, transcripts, and the names and contact information for three (3) business references to https://www.eiu.edu/~humanres/application/login.php. Applications should be received by April 15, 2024, to ensure consideration for this position.

EIU offers an excellent benefits package, including competitive employee insurance premiums as well as flexible options for medical coverage. Vision insurance is included at no cost and dental insurance is available. Eligible employees participate in the State University Retirement System, which offers medical insurance upon retirement. Tuition waivers are offered for continued educational goals, and a generous paid time off package includes at least 12 paid holidays, earned vacation, and sick time.

Eastern Illinois University is an Affirmative Action/ Equal Opportunity Employer – minority/female/disability/veteran – committed to achieving a diverse community.Permalink -

EIU NON-NEGOTIATED CIVIL SERVICE COUNCIL SCHOLARSHIP AVAILABLE (Application Deadline extended to May 1, 2024)

READ MORE

Applications are being sought at this time for the Non-Negotiated Civil Service Council scholarship. This scholarship was started to commemorate the 35th anniversary of the EIU Civil Service Council.

Applicants that receive financial assistance or tuition waivers are encouraged to apply. The scholarship is intended to assist with tuition, fees, or other costs associated with attending EIU 9such as housing, supplies, daycare, gas, etc.). The award is payable in Fall 2024 to your student account, and any remaining amount will be dispersed to the recipient. Fall 2024 enrollment must be verified before the scholarship is awarded.

The recipient must: 1) be a former, current, or retired Non-Negotiated Civil Service Employee; or a child or grandchild of a former, current, or retired non-Negotiated Civil Service Employee; 2) be a current or incoming freshman, sophomore, junior, senior or Graduate EIU student at enrolled in a minimum of 6 semester hours; 3) maintain a minimum GPA of 2.5 and in good academic standing; high school seniors accepted to EIU shall enroll in a minimum of 6 semester hours of coursework and be ranked in the top 25% of their class. Financial need shall be the determining factor if all other qualifications are equal.

Please apply online at https://eiu.academicworks.com/opportunities/15788

The deadline has been extended to May 1, 2024.

If you have any questions, please contact EIU Civil Service Council President, Michelle Morgan at (217) 581- 6025 or email mlmorgan@eiu.edu.

Permalink -

Non-EIU Event Submission for EIU Calendar

READ MORE

The Marketing & Communications web team are thrilled to share that the EIU Events Calendar can now feature non-EIU events too! Our aim is to strengthen the bond between the EIU campus and the surrounding community, providing everyone at EIU the chance to engage in local happenings.

Community businesses and organizations holding events that could appeal to the EIU community are welcome to submit their event through this form. Our team will evaluate the details and if suitable, we'll feature them on the calendar. This way, your event can reach out to EIU students, faculty, staff, and annuitants.

Please share this update with your community associates and let them know about this exciting opportunity!

go.eiu.edu/communitycalendar

Permalink -

Faculty/Staff Yoga in SP24 Semester - Register Here!

READ MORE

Faculty/Staff Yoga is back! Join us in McAfee North Gym Mondays and Fridays at 12:05 for yoga with Raven. All levels welcome, from beginner to advanced, just bring your mat and water bottle!

Registration appreciated, but not necessary: CLICK HERE to register.

Permalink

-

Travel Rate Changes

READ MORE The Illinois Higher Education Travel Control Board has recently revised its regulations to align with federal government reimbursement rates for both domestic and international travel. This adjustment is anticipated to simplify the process of locating hotels within the approved rates for travelers. Effective January 2, 2024, the Business Affairs dashboard has been updated to adhere to these modifications. Consequently, travelers will be required to provide more comprehensive information in the dashboard to ensure accurate rate calculations.Moving forward, further adjustments will be implemented in accordance with changes in federal government rates.For any inquiries, please reach out to Procurement, Disbursements & Contract Services at 217-581-5313.Permalink

The Illinois Higher Education Travel Control Board has recently revised its regulations to align with federal government reimbursement rates for both domestic and international travel. This adjustment is anticipated to simplify the process of locating hotels within the approved rates for travelers. Effective January 2, 2024, the Business Affairs dashboard has been updated to adhere to these modifications. Consequently, travelers will be required to provide more comprehensive information in the dashboard to ensure accurate rate calculations.Moving forward, further adjustments will be implemented in accordance with changes in federal government rates.For any inquiries, please reach out to Procurement, Disbursements & Contract Services at 217-581-5313.Permalink