July 11, 2013 Chapter Meeting Minutes

I. Welcome, Overview of Program, and Introduction: Association President Julie Sterling welcomed attendees to the meeting, thanked EIUAA Board members for their contributions to the Association, and thanked the LifeSpan Center staff – and in particular Program Director Jean Shobe and RSVP Director Tracy Peterson -- for their help in arranging the meeting.

II. Announcements: Julie Sterling made the following announcements:

A. At the October 24 EIUAA Chapter meeting at the LifeSpan Center, Janice Bonneville, Deputy Director of CMS, will make a presentation on changes in Medicare insurance and other health insurance issues.

B. Persons potentially interested in becoming SHIP (Senior Health Insurance Program) volunteers are encouraged to speak with Tracy Peterson at the LifeSpan Center.

C. Persons interested in assisting EIUAA's Board of Directors are asked to speak with President Sterling.

D. D. A tour of the LifeSpan Center will be offered following today's Chapter meeting.

III. Presentation by William Mabe, Executive Director, SURS: In the course of his PowerPoint presentation, supplemented by a handout, Mr. Mabe made the following points, among others:

A. SURS assets are expected to generate a 12% to 14% rate of return this fiscal year.

B. The state appropriation to SURS for FY 213 is $1.4 billion — the amount SURS had requested. Mr. Mabe will request $1.5 billion next year.

C. SURS benefit expenses have "essentially doubled" in the past ten years.

D. SURS membership growth (i.e., the number of persons hired) has been down in recent years. In approximately five years we will have more retirees than active employees in the system.

E. SURS processed a record number of retirement claims in June and July of 2012.

F. SURS provides pension information to state legislators but does not lend its support to any of the "pension reform" proposals.

G. Mr. Mabe responded to questions from his audience as follows:

Q: Will legislators' decisions re: pensions be "political"?

A: Legislators will want to "move the needle" substantially if they pass changes to the pension system; i.e., since we will be unhappy with whatever "pension reform" they approve, they may as well make the "reform" a substantial one rather than one that makes only minor changes.

Q: Why do legislators and journalists use the misnomer "COLA" when referring to annuitants' AAI (Annually Adjusted Increase)?

A: The public understands the term "COLA." Nuances "get washed in the discourse."

Q: Are legislators aware of the impact their pension proposals would have on annuitants' lives?

A: Legislators are aware of the impact their proposals would have on annuitants' lives. When they say, "It's all about the numbers," they are evincing their concern with "making the math work."

Q: "Are other retirement systems in the state like ours?"

A: "The General Assembly Retirement system is in worse shape than ours."

IV. Presentation by Linda Brookhart, Executive Director, SUAA: Linda Brookhart offered brief reports on the status of the conference committee on pension reform and on development of the state-sponsored Medicare plan, currently in progress.

A. Conference Committee on Pension Reform: Committee members have interacted civilly. Senator Biss and Representative Nekritz seem open to new ideas, and committee chair Raoul is "taking charge," having made clear his belief that the Governor's July 9 deadline for agreeing on a plan was unrealistic given the additional time that will be needed to gather actuarial data on any proposal eventually agreed to. "Whatever comes out of conference committee," Ms. Brookhart added, "will need to be voted on by the legislature."

B. State-Sponsored Medicare Plan: The State-Sponsored Medicare Plan currently under development "almost looks like it is going to be an HMO." While we wait to learn details of the plan, annuitants are encouraged to "shop for health insurance." What seems all but certain is that our health care costs in the future will go up and our benefits will go down.

V. Reminder: The October 24 EIUAA Chapter Meeting will again be held at the LifeSpan Center. Janice Bonneville, CMS Deputy Director, will discuss changes in Medicare insurance and related health insurance issues.

- The meeting adjourned at 10:41 a.m.

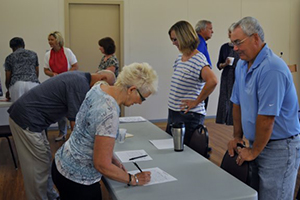

The Meeting in Pictures

Click the images below for larger versions.